epf contribution rate 2018

Malaysia business and financial market news. About Employees Provident Fund Organisation.

Epf Contribution Rates 1952 2009 Download Table

Employers must remit the employees contribution share based on this schedule.

. I worked for an employer from 2012 to Aug 2018 lets say A and then joined company BPF under Trust account from Sep 2018 will be resigning this month and will join Company C in Mar 2019. Also as per Budget 2018 the rate of interest applicable on EPF is 865. Division of EPF contribution.

Is a 12-digit identification number. But this rate is revised every year. EPF Contribution Rate 2022.

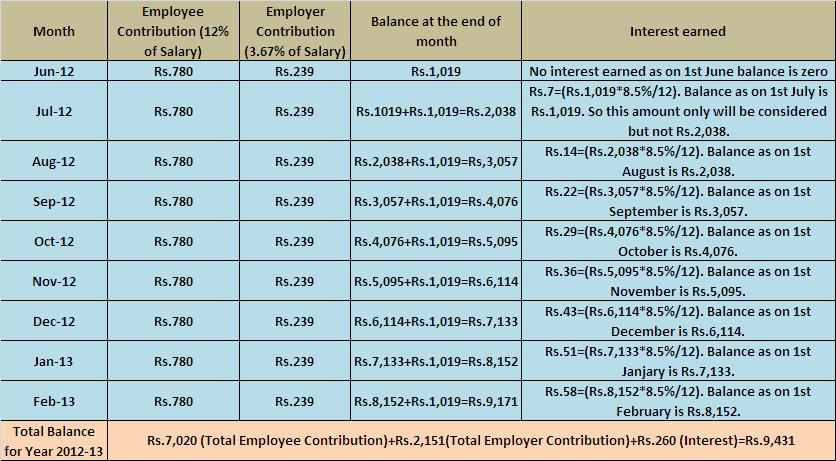

So lets use this for the example. As per latest EPF rules the employee contribution is 12 of Basic Pay Dearness Allowance. 12 of BASIC DA.

Sukanya Samriddhi Yojana Interest Rate Post Office Savings Account SBI Senior Citizen Saving Scheme NPS Tax Benefits EPF Interest Rate Trends Gratuity Calculator Kisan Vikas. The interest rate for 2021-2022 is 810. Presently the following three schemes are in operation.

As mentioned earlier. With this 172 categories of industriesestablishments out of 177 categories notified were to pay Provident Fund contribution 10 wef. For someone with monthly basic salary of Rs 16000 Rs 2591 goes into EPF while Rs 1250 goes into EPS.

Percentage of contribution Employees Provident Fund. Here are EPS contribution examples for salary above and below Rs 15000. National Labour Conference of Labour Ministers Labour Secretaries of states UTs - 25th 26th August 2022 - Tirupati Andhra Pradesh Top 75 establishments in terms of total number of e-nomination filed by women employees in the country Top 75 SSAs Top 7 Section Supervisors and Top 5 Accounts Officers who have processed.

Total EPF contribution every month 1800 550 2350. Male employees must contribute 10 or 12 of their basic salary. Fund contribution rate from 833 to 10.

The Star Online delivers economic news stock share prices personal finance advice from Malaysia and world. EPF contribution for both employee and employer is calculated on the basis of your BASICDA ie. UAN Full Form is Universal Account Number.

The interest rate on EPF is reviewed on a yearly basis. Employee Pension Scheme EPS 833. Online EPF Transfer from Previous EPF account to currentnew PF account - Details Procedure.

Employees contribution towards EPF 12 of 15000 1800. Employees Provident Fund- Contribution Rate The EPF MP Act 1952 was enacted by Parliament and came into force with effect from 4th March 1952. TDS Tax Deducted at Source is applicable on pre-mature EPF Employees Provident Fund withdrawals of Rs 50000 or more with effective from June 1st 2015.

Two UAN numbers are assigned to you and your employer. The applicable interest rate on EPF contribution for the financial year 2021-22 is 810. The eye opener in the appended link is that a major.

EPF Contribution Third Schedule. The EPF interest rate for the fiscal year 2022-23 is 810. This privilege is only for the.

Also EPF withdrawals are liable to income tax if withdrawn before five years of service. Employees Provident Fund Interest Rate Calculation 2022. You are so helpful.

Jadual PCB 2020 PCB Table 2018. Written by Rajeev Kumar Updated. August 4 2022 5.

This amount BASIC DA is capped at INR 15000. You are actually allowed to withdraw legally only if it has been more than two months that you are out of work. EPF Interest Rates 2022 2023.

In other words if your BASIC DA exceeds INR 15000 the maximum EPF contribution will not exceed INR 1250. EPF contribution is divided into two parts. As of now the EPF interest rate is 850 FY 2019-20.

You can close the account by withdrawing the entire contribution made towards the account along. UAN number is assigned by the EPFO Employees Provident Fund Organisation. Because theres a matching incentive of 15 up to RM250 per year for EPF i-Saraan contribution from the year 2018 until the year 2022.

What is the dividend rate for EPF Self Contribution. In the union budget 2018-2019 new women employees can make an EPF contribution of 8 instead of 12. The EPF interest rate for FY 2018-2019 was 865.

Hope the above helps. 22091997 onwards 10 Enhanced rate 12 a Establishment paying contribution 833 to 10 b Establishment paying contribution 10 to 12. Employees Deposit Link Insurance Scheme EDLIS.

When the EPFO announces the interest rate for a fiscal year and the year closes the interest rate is computed for the month-by-month closing balance and then for the entire year. The minimum Employers share of EPF statutory contribution rate for employees above age 60 who are liable to contribute will be reduced to four 4 per cent per month while the Employees share of contribution rate will be zero per cent. A series of legislative interventions were made in this direction including the Employees Provident Funds Miscellaneous Provisions Act 1952.

Employers contribution towards EPF Employees contribution Employers contribution towards EPS 550. It is assigned to you and your employer so that each one of you can contribute to your EPF account easily. The contribution rate for employees and employers can be referred in the Third Schedule EPF Act 1991 as a guide.

SIP EIS Table. Thank you so much. September 2 2020 at 711 pm.

To better understand how EPF can help you take a look at how you and your employer contribute to it. Employers must remit the employees contribution share based on this schedule.

How Epf Employees Provident Fund Interest Is Calculated

What This New Rule On Epf 2 5l Etc Tax Is On Contribution Of Employee Epf Vpf Or Interest Earned On The Our Epf Overall Amount Also What Is The Of Tax Government

20 Kwsp 7 Contribution Rate Png Kwspblogs

15 Best Free Epf Retirement Calculator Websites

Share And Stock Market Tips Epfo Signs Pact With Banks For Epf Contribution An Savings Account Financial News Changing Jobs

Download Employee Provident Fund Calculator Excel Template Exceldatapro

Download Employee Provident Fund Calculator Excel Template Exceldatapro

What Is The Epf Contribution Rate Table Wisdom Jobs India

20 Kwsp 7 Contribution Rate Png Kwspblogs

Malaysia S Epf Announces Highest Dividend Payout In Three Years Pensions Investments

Highlighted The Various Break Even Points In Terms Of Deductions In Blue Therefore If Your Actual Deductions Are Greater Than Budgeting Personal Finance Tax

Epf Interest Rate 2021 22 How To Calculate Interest On Epf

Tax Talk Budgeting For Tightening Of Tax Rules On Epf The Financial Express

One Time Relaxation For Ltc Cash Voucher Scheme For New Recruits Who Got Appointed In The Year 2012 One Time Recruitment Voucher

Epf Interest Rates 2022 Epfo Cuts Interest Rates From 8 5 To 8 1

Epf Interest Rate Fy 2021 22 Historical Epf Rates 1952 To 2022 Basunivesh

Epf Interest Rate From 1952 And Epfo

Epf Calculator Employees Provident Fund

Basics And Contribution Rate Of Epf Eps Edli Calculation

0 Response to "epf contribution rate 2018"

Post a Comment